DeFi Arts Intelligencer - June 27th, 2020

Welcome to the 23rd issue of the DeFi Arts Intelligencer, your weekly source for key happenings around Ethereum art, collectibles, and games. Subscribe here.

🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶

For this dispatch:

🎨 Digital Art & Collectibles

#NiftyPride parade and its LGBTQ creator expo kicked off in Cryptovoxels today 🏳🌈 Job well done by the organizers!

The bidding on Robbie Barrat’s “saint nazaire” has reached 28 ETH …

NFT art platform SuperRare launched support for tokenized 3D artworks. Also, The LAO, a venture DAO, invested in SuperRare this week.

The specialists at NonFungible released their “Non-Fungible Art Report 2018-2019.”

Decentraland hosted a slew of great gallery openings, including from MakersPlace, KnownOrigin, Mintbase, and SuperRare.

At the after party of Thursday’s WIP meetup, collector and entrepreneur WhaleShark unveiled E1EE7: a new eSports apparel company that will have an associated store in Cryptovoxels for NFT wearables.

🕹️ Blockchain Games

Axie Infinity maestros Axiegg have joined forces with BattleDAO to run the Three Horsemen Battle Royale, an open Axie Infinity team event with a 100 Dai prize pool.

Ethereum gaming platform The Sandbox sold out its MoonSale Waxing Crescent wave in 3 minutes. The MoonSale Waxing Quarter arrives on June 30th.

♦️♦️ DeFi News

Decentralized exchange Uniswap is on course to power $400 million in trade volume this month — more than the DEX facilitated in all of 2019.

Balancer, a new automated liquidity protocol, started distribution of its BAL governance token this week.

MakerDAO has put forth an Executive Vote to add KNC and ZRX as approved Maker collateral types.

📰Fresh Content

“Augmented Reality NFTs” - David Gabeau

“Jason Bailey - The Convergence Of Art And Tech - ep 26” - Andrew Steinwold

“This Artwork Is Always On Sale v2” - Simon de la Rouviere

“Breaking Down the 1st Week of Avastars Gen1 Series 2” - moi

🖌️Extra, Extra

You can find the Big NFT Drops calendar here. Got anything coming up? Let me know, I’ll see about adding!

This week I chatted with the NFTfi.com team for a Q&A on their marketplace for NFT-collateralized loans. I think these loans could become quite popular going forward as the NFT ecosystem continues to blossom, so I really appreciated the interview. You can find the results of our conversation below.

WMP: So what’s the NFTfi.com elevator pitch? Why NFT-collateralized loans, and why now? Did you have an “aha!” moment that got you started?

NFTfi.com: Hi William, thanks for taking the time to talk to us.

NFTfi is a simple peer-to-peer marketplace for NFT collateralized loans. NFTfi allows you to put any ERC-721 NFT assets up as collateral for a loan or offer loans to other users on their NFTs. Once a loan is started, NFTfi holds the asset in escrow. If the borrower pays back the loan the asset is transferred back to them — if not the asset will be transferred to the lender. In the traditional art world, this is called a non-recourse loan.

The “aha!” moment was probably realizing NFTfi.com was still available!

Jokes aside, it was a conversation between Mads and myself in February. I called to get his take on the ETH price because I was opening a Maker CDP. We talked about needing a way to unlock some of the value in our NFT collections, too. We did a lot of research and realized there was nothing out there that did what we wanted. For us, the P2P price discovery and user driven marketplace was essential, and we had lots of ideas to help support liquidity more broadly too. Alas, we decided to build it ourselves. Two weeks later, we had the first version of the smart contract ready. Strange experience really, it just felt right when we discussed the initial product MVP. It was a need that we both personally felt and had heard many people talk about.

Why now, then?

Well we feel the NFT market is poised to grow rapidly, however liquidity is a big problem in the NFT space. Even in mature art and collectible markets there is a huge need for liquidity, and non-recourse loans are common for museums to use too. Currently there are lots of amazing opportunities for people who are plugged in to the NFT space to buy and sell with profit, but at any given time liquidity can be an issue to maximize that opportunity. It could also be an artist wanting to fund a larger body of work or collaboration. We think liquidity helps in many places if done right. We want to be here and grow with the market and help improve the space for all its participants. That’s the governing principle.

WMP: How much loan activity has the marketplace seen so far? What kind of NFTs have you observed folks using as collateral this early on?

NFTfi.com: We’ve been live on mainnet for just less than a month and have been sharing the platform with the community for just over 2 weeks now.

So far we have seen 110 listings, 38 of which resulted in loans (a 35% conversion rate). Our total loan volume so far is 26.3 ETH and is growing by roughly 35% every 3 days (see the chart below).

Our 3 largest loans so far have been:

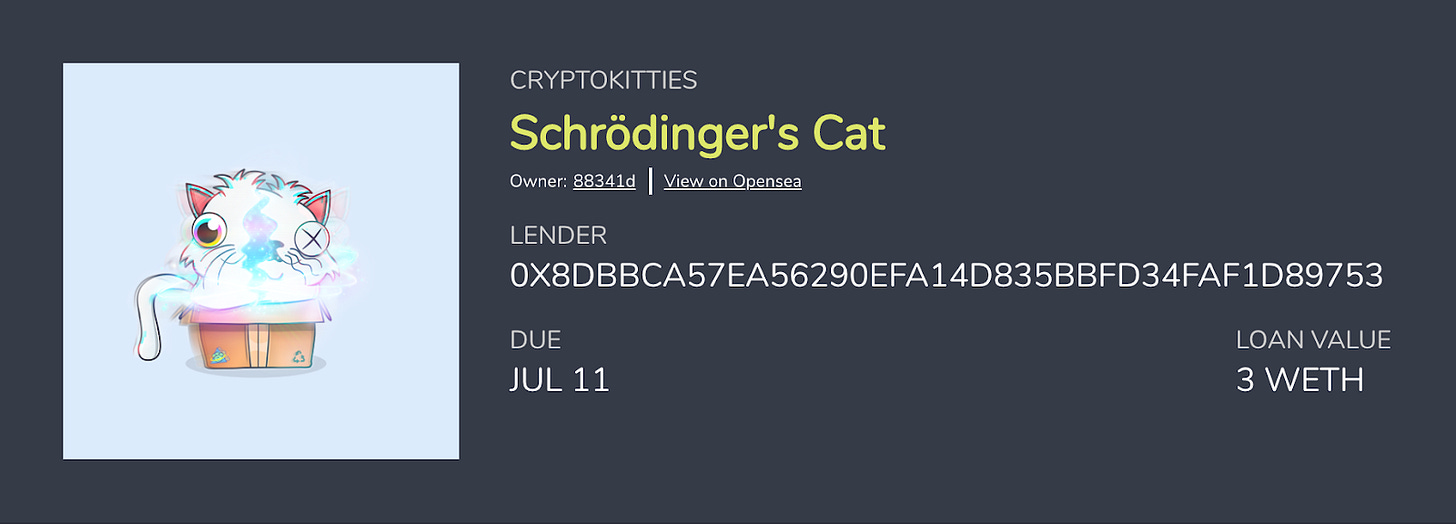

Cryptokitties - Schrödinger's Cat: 3 ETH over 30 days

JOY - Flower & Toad: 3 ETH over 30 days

Josie - Your’s Truly #5: 3 ETH over 30 days

If we break that down by project, it looks very similar:

CryptoKitties: 6.91 ETH total loan value

JOY: 4 ETH total loan value

Josie: 3.6 ETH total loan value

As you can see older projects and especially art projects seem to be doing well. There has also been a lot of interest in Avastars and Cryptovoxels, too.

WMP: Where do you see the NFT economy going in the next 5 to 10 years?

NFTfi.com: Over the next 5 to 10 years we expect the NFT economy to grow significantly. There are a number of forces driving this. The growth in the number and quality of cryptoartists is sensational. We expect this trend to continue with more and more established artists entering the NFT space.

We also expect to see real world assets tokenized as NFTs. There are already a number of projects working on this. The legal issues associated with tokenizing real world assets are not trivial but we expect somebody will figure it out :-)

We also expect to see the ongoing DeFi-ification of the NFT space. The explosion of money legos we’ve seen in the DeFi space makes us excited to see the combinational explosion of combining NFTs into existing DeFi protocols.

Lastly, we expect to see at least one blockchain-based game getting significant mass market traction.

WMP: What does NFTfi.com have coming up on the slate? Any new features or updates in the works that users can expect in the near future?

NFTfi.com: Basics first — we’re getting a TON of feedback from users at the moment, which is amazing. Can’t thank them all enough. Things like specify requested loan terms, more wallets supported, and better account pages to push/share/market your assets. Bundles is also an idea we like a lot.

Longer-term, our mission is to increase the liquidity of the NFT market in general and to provide additional data that will allow NFT collectors and investors to make more informed decisions when valuing NFTs, thus allowing the next cycle of market maturity to occur. That could also include automation and scaling of some aspects of the process of course. There are four major markets: digital art, collectibles, gaming, and real world assets that all converge now with NFTs and plug directly into the platform. Staying on top of that explosion and serving the community well will be a huge and rewarding challenge.

WMP: When you look around the space, are there any other NFT projects that are really exciting your team right now?

NFTfi.com: There is so much cool stuff going on in this space it’s hard to pick favorites. But since you asked we have to answer! They include:

Avastars

We love their work and the push for better standards and keeping everything on chain. We have already seen users being more comfortable giving longer term loans on projects that store all their metadata on chain. Besides that, they are just cool!

NBA Top Shots

Although it is built on Flow and not Ethereum, it is SUPER exciting to get such a big project launching. We’ve already seen a drive of people taking out loans on NFTfi to prepare liquidity for the initial launch.

Chainlink

We wanted to add Chainlink because of the Dynamic NFT’s with Chainlink Oracles. We think this and projects like it will pave the way for more traditional gaming companies to integrate NFT’s in their offerings.

Thanks for reading, and stay creative on- and off-chain!

Keep an 👁️ out for the 24th issue of the DeFi Arts Intelligencer this time next week, too. Cheers ✌️

🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶🔷🔶

About DeFi Arts Intelligencer

The DeFi Arts Intelligencer is curated by me, William M. Peaster, a professional writer and editor who’s been tracking the Ethereum and Dai beats in recent years.

I’m passionate about art and a DeFi optimist, so putting together this newsletter is both fun and informative for me. I hope others may find the content helpful, too. But be mindful, the information herein should not be construed as investment advice. I’m not a financial adviser, and these are my opinions. Always take care to seriously consider the various layers of risk you face in participating in the still-maturing cryptoeconomy.

If you have a DeFi tip or lead, questions or comments, or would be interested in commissioning me for a writing gig, you can ping me at wmpeaster@gmail.com or on Telegram at @wmpeaster.

If you enjoy this newsletter and want to support it, feel free to subscribe or have a like-minded friend subscribe as well. I have NFT pieces available for sale, too, or you can tip me at wmpeaster.eth. Thanks kindly!